Updated data capture details of debt collection lawsuit process as of December 2023

While most states and US territories have laws that specifically govern some aspect of debt collection lawsuits, the laws vary widely and offer few protections for consumers, according to new data released today by the Center for Public Health Law Research at Temple University Beasley School of Law.

Between January 1, 2023, and December 1, 2023, seven states — Colorado, Illinois, Minnesota, Nevada, New York, North Dakota, and Vermont —made substantive changes in their laws governing debt collection lawsuits. Most of the changes provide increased support and protection to consumers by requiring plaintiffs to provide more information about the debt in lawsuits to collect medical debt, requiring that notice of a lawsuit must provide specific information on how to respond to the suit and how to obtain legal assistance, or by limiting extensions of statutes of limitations for debt claims.

“It was encouraging to see states amending their laws to adopt approaches that may provide additional support for consumers facing debt collection lawsuits,” said Katie Moran-McCabe, JD, a Lead Law & Policy Analyst at CPHLR and the lead researcher on this project. “By tracking these laws over time, we can better understand how those changes may affect health, well-being and equity in the long term.”

The dataset uncovers the vast variety in debt-lawsuit-specific laws: Some states have laws that apply to consumer debt claims generally, while others have laws that apply more specifically to, for example, claims for credit card or medical debt, or to claims brought by debt buyers or collection agencies.

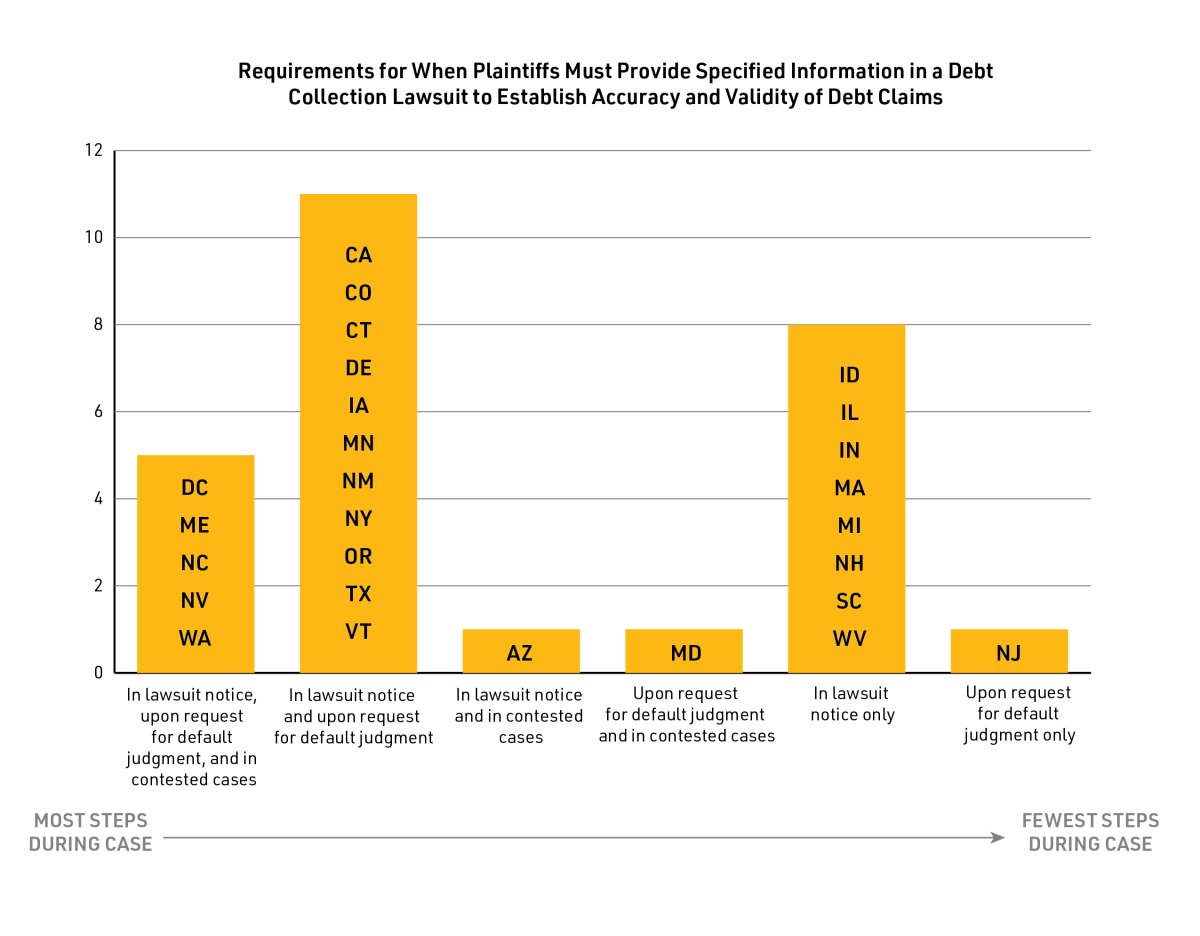

As of December 1, 2023, the data also show:

- Twenty-two jurisdictions have laws that specifically apply to debt lawsuits brought by a third party, such as debt buyers, assignees, or collection agencies.

- Twenty-seven jurisdictions require debt-specific information to be provided to the court at some point in the lawsuit process to further substantiate their claim, regardless of whether the defendant has answered the claim or requests such information.

- Twenty-three jurisdictions require at least some debt-specific information to be sworn or affirmed under penalty of perjury (typically by providing the information in an affidavit).

- Many states have laws that may deter consumer debt collectors from filing in small claims court through various restrictions: 18 jurisdictions prohibit third parties (such as debt buyers or assignees) from filing in small claims court, 14 jurisdictions prohibit plaintiffs from being represented by a lawyer in small claims court, and eight states impose a limit on the number of filings a single plaintiff can bring in small claims court per week, month, or year. On the other hand, seven states and the District of Columbia require all civil claims (including debt claims) under a specified amount to be filed as small claims.

The dataset, which is available for free and open access on LawAtlas.org, was created with support from The Pew Charitable Trusts. It provides an overview of the entire debt collection lawsuit process in all 50 states, the District of Columbia, American Samoa, Guam, Northern Mariana Islands, Puerto Rico, US Virgin Islands, from January 1, 2023, through December 1, 2023.

The data are accompanied by a short policy brief that describes the current legal landscape, offers policy recommendations based on existing evidence, and proposes a future research agenda.